A couple of recent reports have highlighted that BSS is set for a bit of a renaissance as service providers start to make the investments needed to grow their business.

In early February TelecomTV published the DSP (Digital Service Providers) Leaders Council Industry Vision Report. As the name suggests this report contained the views of senior execs in service providers and analysts who have their fingers on the pulse of what’s driving the industry. A few of the highlights were:

- Most service providers (65%) want to develop a wide digital services portfolio so they can remain relevant.

- 75% feel that their service development efforts should be targeted at enterprise customers. In other words, B2B is where they stand to make the greatest return on investment.

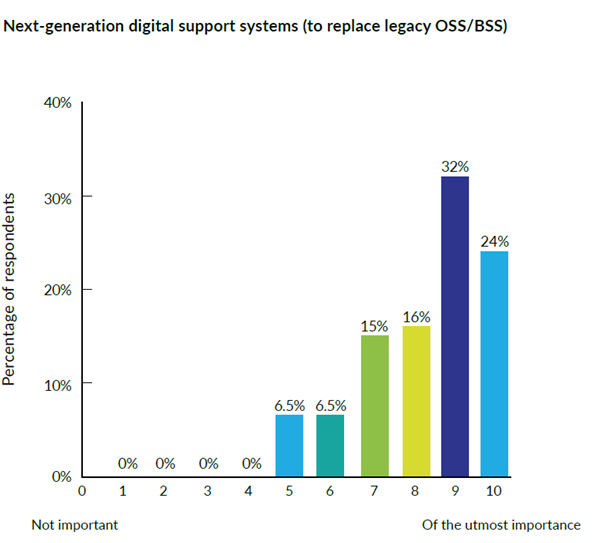

While the importance of B2B and selling more digital services to customers may be telling a lot of people in the industry what they already know it was good to see these results providing confirmation. What was interesting is that service providers know what they need to do to turn these aspirations into reality. This is especially true in OSS/BSS. As can be seen from the results below—from the DSP Report—when it comes to the need to replace legacy OSS/BSS stacks, the service providers aren’t exactly sitting on the fence.

Given a scale of 1 to 10 (with 10 being ‘of the utmost importance), when asked about the importance of replacing legacy OSS/BSS 56% of service providers scored 9 or 10. It’s clear that many service providers see the need to replace the old systems that have kept their businesses going for the last 20 years or so. Systems need to be modernised to enable faster roll-out of new digital services as well as being able to support the needs of B2B customers (complex hierarchies, sales force automation, etc). There is also the fact that the service provider of the next 5 years will be unrecognisable from the telcos of old. Service providers are becoming digital companies. They can provide cloud and ICT services, digital healthcare, education, entertainment, and any service that they can deliver over a mobile and /or fixed broadband connection. To do this, many are getting rid of legacy stacks and becoming greener and more efficient through system consolidation.

As well the TelecomTV DSP Leaders Report, in November 2023, leading analyst firm, Analysys Mason published an article with the self-explanatory title, CSPs’ spending on telecoms-related OSS/BSS software and services will reach USD80 billion by 2028. This article forecasts CAGR of 5% between 2022 and 2028. Drivers for this increased investment include the need to make more revenue from 5G SA networks. This includes service providers needing to provide new services with extended value chains and manage partner channels. However, it’s not just a case of spending money on new systems to make money from new offers. New system investment is also being driven by the need to become more efficient through increased automation of processes. System consolidation and having a single platform support all services (mobile, fixed broadband, and beyond connectivity services), SaaS, and the move to the cloud are also driving investment in BSS.

Is this the start of a renaissance for BSS? It is starting to look like it. If service providers are serious about increasing their digital portfolios and having an increased focus on serving the B2B markets, then they’ll need business systems that can turn opportunities into revenues.

Bahareh Ghorbani

Product Portfolio Manager