Ask anyone in a CSP what their top ask from BSS is and across the board, you’ll pretty much get the same answer: Agility. However, as the rate of change is accelerating in telecoms, agility is a moving target. Once a CSP has implemented changes to become more agile, the market has already evolved and so the CSP has to look at the next level of agility. There’s no end goal here. For CSPs, change is now constant and it’s those ones who can react the fastest to change that will be the ones most likely to grow revenues.

Agility is often measured by time to market. This means how long does it take for a CSP to get a new offer set up on BSS and monetization systems and to launch it. According to a new CSP survey and report from TM Forum (Transforming BSS – Racing to a Flexible, Customer-Focussed Future), this can take anywhere from under one week to two months. The introduction of new offers requires change to the BSS. For some, this can involve the configuration of rules and parameters with no coding involved. For others, it can involve getting the vendor to do code changes, which adds additional time and cost.

The report also highlighted that 49% of CSPs are increasing the number of offers they’re launching in 2023 compared to 2022. With the rollout of 5G SA set to gather pace in 2024, this figure will also increase next year. With regards to the speed of getting new offers out there, there are more than just the BSS change management costs to consider. On average approximately 50% of an IT budget goes on support, maintenance, and change management of BSS. Perhaps more worrying than the high costs of maintaining and changing legacy stacks is the fact that 91% of CSPs said that they have lost business opportunities due to slow product launches.

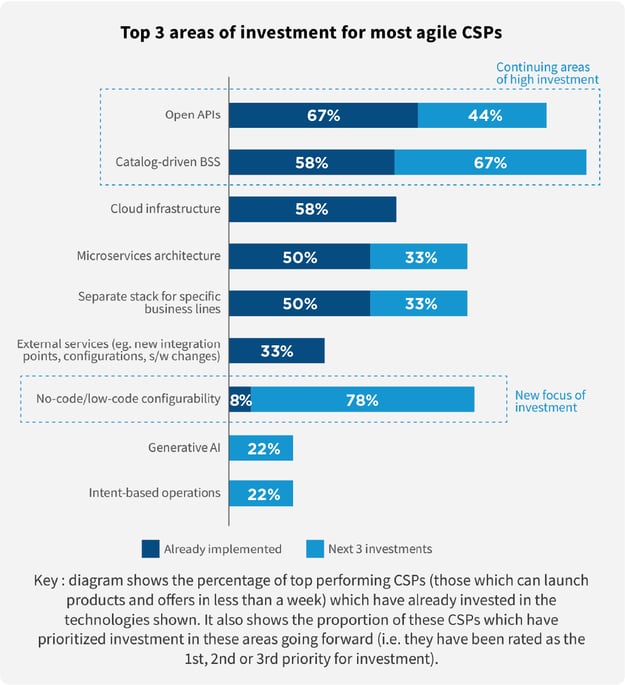

So, what are CSPs doing to increase agility? The top 5 investment priorities for CSP to increase agility and flexibility are catalog-driven BSS, open APIs, microservices architecture, no/low code configurability, and a separate stack for specific business lines. This is for all CSPs. However, when we take a look at the investment priorities for the most agile CSPs we get a different picture. For the survey, TM Forum described agile CSPs as those who have a time to market of 1 week or less.

As can be seen in the above figure, the majority of agile CSPs have already invested in catalog-driven BSS, open APIs, and cloud infrastructure. Catalog-driven BSS, open APIs will continue to be an area of new investment. At present, only 8% of agile CSPs have invested in no/low code configurability, but a massive 78% of them have this in their next three investment areas. It’s no coincidence that this new investment focus comes at the same time when CSPs are starting to roll out 5G SA, are turning their attention to selling ICT and other ‘beyond connectivity’ services to B2B customers, are entering new vertical markets, and are exploring new B2B2X business models. To embrace these new opportunities will need a step change in BSS agility. TM Forum’s report, BSS Transformation, said, “No-code / low-code is the next big thing…the most agile CSPs are looking to no-code / low-code to take agility to the next level by democratizing, accelerating and lowering the cost of change.”

Download the TM Forum Report: Transforming BSS – Racing to a Flexible, Customer-Focussed Future

Varun Galande, VP Sales

Qvantel